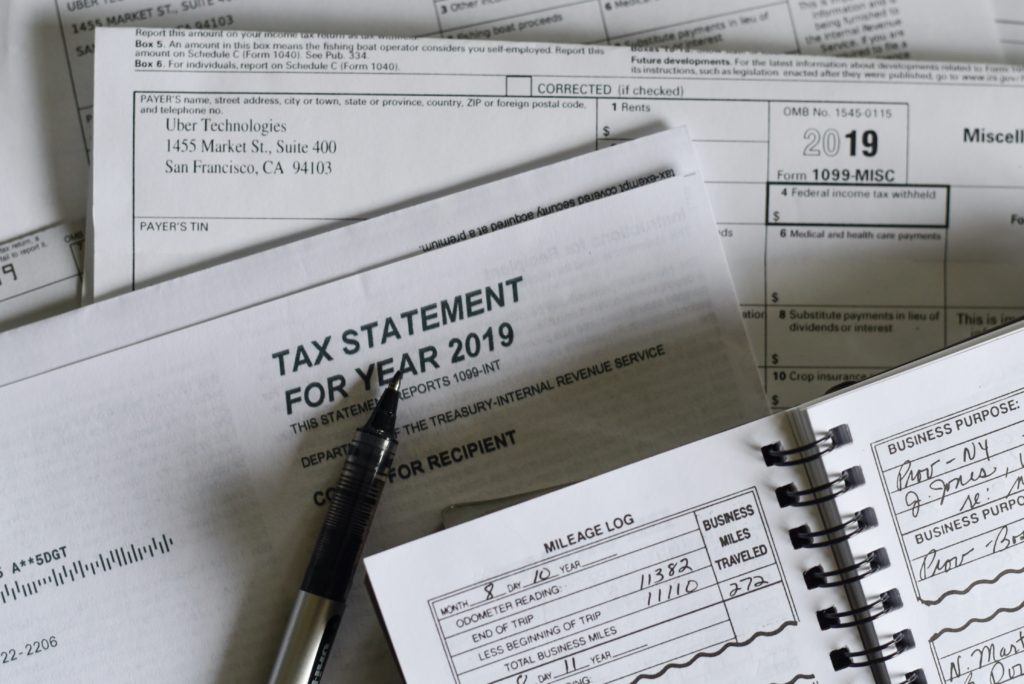

Tax Compliance

There are more than one million US citizens living in Canada. These individuals remain subject to tax by the IRS on their worldwide income and have annual filing obligations with significant penalties for non-compliance. As Canadian residents, they are also subject to Canadian taxation on worldwide income. This potential for double taxation is largely resolved …